Unsecured Home Improvement Loan Arizona Central Credit Union

Table of Content

By contrast, a secured loan uses collateral that a lender can repossess if you default on the loan, such as a home or a vehicle in the case of a mortgage or a car loan, respectively. Upgrade was launched in 2017 and provides accessible online and mobile credit and banking services in every state except Iowa, Vermont and West Virginia. Since that time, the platform has made more than $3 billion in credit available to over 10 million applicants and continues to expand its online and mobile services. Although maximum APRs are on the high end compared to other online lenders, Upgrade makes loans available to those with poor credit history. Some of the home improvement loan options that homeowners in Wisconsin are considering include home equity loans, home equity lines of credit, personal home improvement loans, and FHA, VA, and USDA loans.

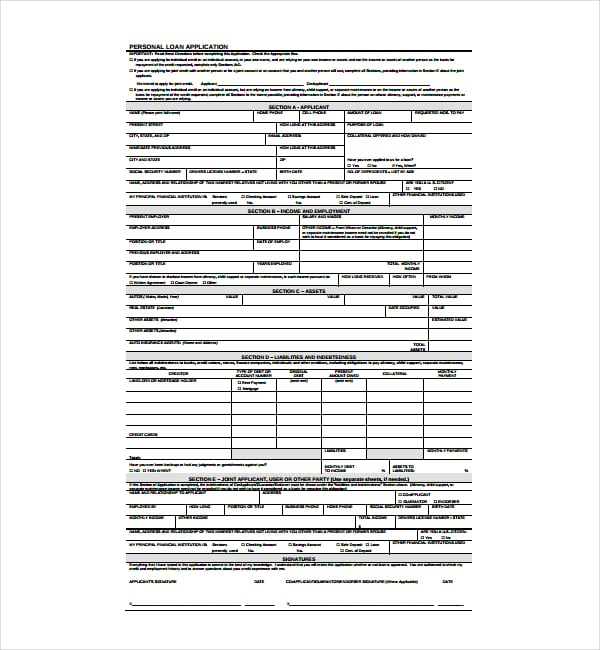

Banks, credit unions and online lenders typically offer unsecured personal loans. You can either apply online or in person, depending on the lender, and then wait for a decision—approval or denial. If approved, you’ll receive your funds as a lump-sum payment, usually by direct deposit into your bank account. Personal loans require fixed monthly payments over the entire loan term, which typically range from one to seven years.

Income

Still, the loan amount may not be sufficient to cover the costs of the home improvements you have in mind. The rates can be upward of 30% if you do not have a positive history. It makes sense to compare lenders as they will often have different offers for people in similar financial positions and who need emergency personal loans or longer-term lending like home improvement loans. Your credit rating and even debt-to-income ratio will be considered. There are specific personal loans for fair credit or even poor credit according to the FICO ratings.

Even if you don’t see a lender offering specific home improvement loans, many will let you select home improvements as your loan purpose when you apply for a personal loan. Home improvement tops many homeowners’ wish list today, with 72 percent planning at least one project in 2022. Many borrowing options are available when financing those goals, but not all possibilities are equal.

Best for a Range of Repayment Terms

This means that if for any reason you are unable to keep up with your monthly payments, a lender is able to reclaim any outstanding balance by selling the property. That’s not to say that an unsecured personal loan isn’t right for everyone, but the reality is that there’s only a few instances when these are going to be your best option (we’ll look at these below). But one of the surefire signs that the home improvement loan you’ve been offered by your bank is really just a personal loan is that it doesn’t use your property as collateral.

And Puerto Rico, and applicants can contact the lender’s customer support team seven days a week; current borrowers have access to customer support Monday through Saturday. And, while LightStream doesn’t offer a mobile app for loan management, customers can access their account through LightStream.com. LightStream is a consumer lending division of Truist, which formed following the merger of SunTrust Bank and BB&T.

They are quick to obtain, often with no start-up fees.

You should expect your lender to inquire into what you plan to spend the money on, but your specific home repair may not affect the approval process one way or the other. Consumers request personal loans to meet a wide variety of financial goals. Some customers request personal loans for home improvement projects.

If you have bad credit and you’re willing to pay more for a home improvement loan, consider applying for a home improvement loan for bad credit. Some lenders might approve you for a loan with a credit score as low as 580. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

You’ll pay interest on the full loan amount and usually have one to seven years to repay it. On the other hand, unsecured loans such as home improvement personal loans can be funded in as little as 1-2 business days after a simple online application and underwriting process. Loan proceeds from a personal loan are typically not monitored, and personal loans can be used for DIY home projects as well as those which use a professional.

You might not meet the lender’s minimum credit scoring requirements if you have poor or bad credit. Even if you are approved, you’ll most likely qualify for a lower loan amount with a higher interest rate. In addition, if you search for home improvement loans with no fees, you can minimize your borrowing costs. Common fees include application fees, origination fees, returned payment fees and prepayment fees, which are penalties for paying loans off before the end of their term. The interest rates on a credit card will usually be even higher than on personal loans, making the total cost of a renovation even more expensive. If you are borrowing money for home improvement, you will want to use the right lending model.

Still, a secured loan may be worth considering if you’re confident the monthly payments won’t be an issue as you’ll likely get a lower interest rate. Plus, managing the loan responsibly could help improve your credit score over time if the lender reports payment activity to the major credit bureaus – Experian, TransUnion and Equifax. If you are having trouble keeping up with your debt repayment, you may be able to take advantage of a process known as a debt write-off. Whether or not your unsecured personal loan can be written off or not depends on your lender and your circumstances. There are a few times when an unsecured loan like a home improvement personal loan may be written off.

Before applying for a personal loan to finance your next project, it’s important to know the benefits and the potential downsides. Choose from multiple loan options with fixed rates and terms designed to fit your budget. Unsecured lines of credit are revolving lines of credit that are not backed by collateral. Consumers can draw from the line of credit at any time and are only responsible for repaying what they borrow.

Access to unsecured loans is determined by several factors, including debt-to-income ratio and credit history. Yes, banks, credit unions and online lenders typically offer loans without collateral. Common types of unsecured loans include unsecured personal loans and student loans. Another popular type of loan that’s much easier to obtain is an unsecured home improvement loan.

Comments

Post a Comment